My first official post!

Here are the topics I’m planning to cover today so that we can get caught up and comfortable with each other:

- Why FIRE?

- Getting Started

- The Historical Numbers

- Q1 2022 Update & Goals

Why FIRE?

I have always been an extremely goal-oriented person.

And from pre-school through to college it was easy to set goals: stack up the A’s.

After college I struggled with finding direction. I realized that when it came to my career, the only way to move up was to…..wait. I had to collect YEARS of experience to get a promotion. Do you remember how slowly time passes at entry level jobs? And I was expected to just wait. For YEARS??

I needed new goals.

I tried goals that were outside of work. I took community education classes. I learned new skills and hobbies. I focused on being a more present friend and partner.

And then I found FIRE.

The FIRE community helped me to set savings goals and a whole new landscape of learning goals. I made plans for what my FIRE life was going to look like. Eventually my partner joined me. Now we had a joint goal to work on together.

And now we are working with purpose – no longer just waiting.

Another strong influence in my desire to FIRE is my parents. My parents were of the generation where you remained loyal to your employer. They have both been at their jobs for nearly 30 years. And they are both miserable.

But they are both only a handful of years away from getting their “full retirement benefits”, so leaving isn’t an option.

Loyalty doesn’t payoff anymore. Financial independence takes the control away from the employer and puts it back in my hands. I love the sound of that!

Getting Started

After college, I got an entry-level job making $19/hour as a Management Analyst. I knew saving money was important, but I wasn’t sure how or where to do it. So I set up my retirement accounts to be just above the employer match and called it good.

Part of my work as a Management Analyst included working with Financial Advisors. I was very interested in what they did for a living, and I knew I was smart enough to do a damn good job at it. So I studied for and got my securities licenses and started working in the back office of a financial advising practice. I made $52k/year, worked 60-hour weeks, and was miserable. But the clients I worked with had incredible wealth accumulation stories. I found their financial plans inspiring.

Then in 2017, I accepted a position the Home Office of a Fortune 500 Financial Services firm making $65k/year plus bonus (my first bonus experience!) as a Controls Analyst. In late 2018, I found the first article that referenced the Financial Independence/Retire Early Community and by 2019, I maxed my 401(k) plan for the first time!

I binge read every blog I could. Every book. Watched videos. I started tracing out the steps I would need to take to get there myself. I dove into understanding the tax-strategy behind accessing retirement money before official retirement age. I was all in. I had seen how accumulation was possible, and now I had a way to push my finish line up too.

It felt like every night I came home and told my partner a new discovery on strategies. I was learning about investing, tax-strategy, expense control, and income maximization. It was fabulous! Like the first time reading Harry Potter or watching The Office (nerd alert!).

It took just over a year before my partner opted to join in on the journey. Together we mapped out our combined FIRE tracking spreadsheets and budgets. We are planning to use our retirement accounts for joint expense money, and our personal non-qualified accounts will be available to each of us for our own discretionary spending.

The Historical Numbers

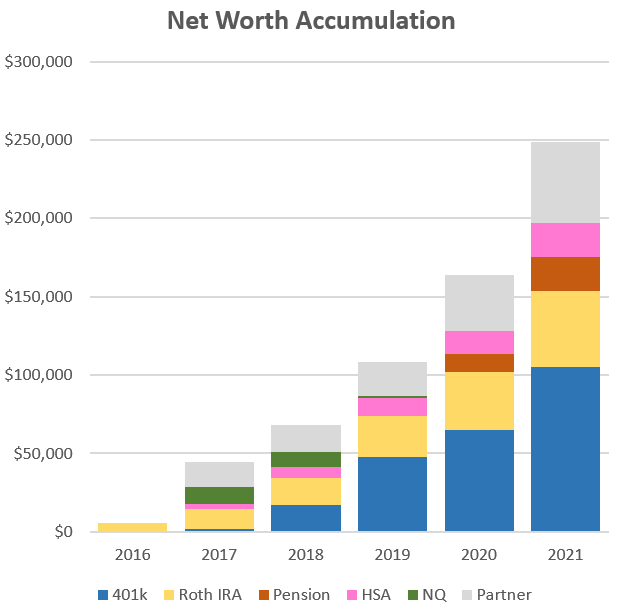

Every good FIRE blog is transparent about the numbers in my opinion! Below are my year-end numbers through 2021.

Our calculated FIRE goal is $1.5M.

My partner’s assets are shown in grey because we are working on our combined goal together.

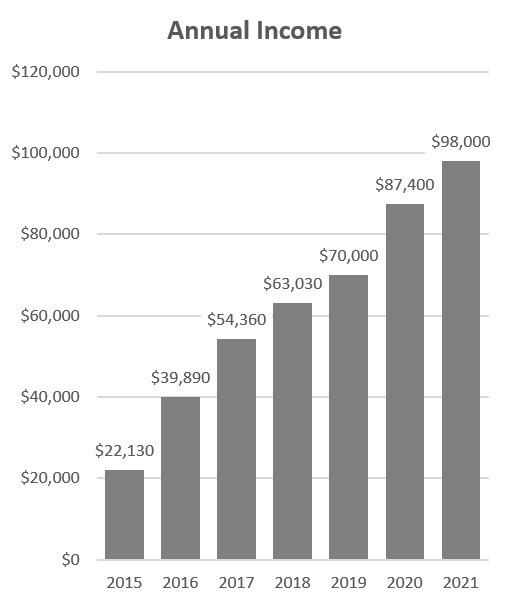

During this time, my partners income varied between $50,000/year and $60,000/year

My annual income has been on the rise year-over-year. I millennial job-hopped four times in 2016-2017 that really contributed to my rise. I also got promoted in 2021.

Q1 2022 Update and Goals

You may have noticed that there are no historical expense numbers listed above! I didn’t track the totals as well as I could have, but I will include them going forward in my year-end summaries.

Our 2022 financial goals include the following:

- Max my 401(k) – ($13,135 of $20,500)

- Max my HSA – ($2,200 of $7,300)

- Max my Roth IRA – Done!

- My non-qualified savings of $10k – ($1,100 of $10,000) behind schedule!

- Partner’s 401(k) savings of $10k – ($1,200 of $10,000)

If we succeed, we will have a total savings of $53,800! Not including the employer match on our 401(k) plans and my pension plan employer contributions.

We have been traveling this year (check in next quarter for details on our travels!) so my non-qualified savings has been slower than expected.

Again, I am so excited to meet you all and share my FIRE story with you!

Thank you for reading!!