Hello again my FIRE flowers!

The topics I am going to write about in today’s update are:

- Tales of Salem

- Marriage and FIRE

- Q3 2022 Update & Goals

Tales of Salem

Our big travel adventure has come to a close. We have safely returned to Minnesota! Our mission was accomplished: we made the most of our time exploring and discovering new places, and we’ve healed our souls a bit from the effects of the pandemic. I feel re-aligned on my life intentions and ready to absorb some new Minnesota memories!

Here is the second little scrapbook that I made to share with you for our last couple stops of the trip:

Marriage & FIRE

For many, the journey to financial independence is a solo experience. It started out that way for me too. As my knowledge of the community and FIRE tactics grew, I would share each new discovery with my partner. I dove into all the beautiful treasures of FIRE: the strategies, lifestyles, and freedoms that FIRE can provide.

He listened to my excitement for this new knowledge for the first several months while offering the occasional reminder that FIRE wasn’t something he was interested in working toward. And that was okay with me! I still enthusiastically showed him around the new budgeting spreadsheets I built, and I shared with him what passion projects I thought that I would enjoy spending my FIRE time working on.

As mentioned on my first post, it took just over a year before my partner opted to join in on the journey. Together we mapped out our combined FIRE tracking and projection spreadsheets and budgets. I am quite pleased with myself for giving him the space to choose FIRE for himself. I can not always contain my patience so well, but I felt this was an important decision not to push him toward.

And here is the very best thing I can report: FIRE has made our marriage stronger.

One of the best things that we have discovered that makes us a better couple is setting and working toward a common goal. And FIRE provided us with not only one big goal, but a variety of subgoals that would give us reason to celebrate our accomplishments together – paying off student loans, maxing saving vehicles, achieving various monetary waterlines.

With FIRE as a goal, we had more candid discussions around our finances, which is a discussion topic that is dreaded or even altogether avoided by some couples – and we love to talk about it! We even have family-budget meetings once a month that are a fun, wine-included, date night!

It also gives us permission to dream beyond our “accumulation career” years – since our working years will come to a divine end in nine years! We frequently pitch ideas for what we will use our time for when we are financially independent. Dreaming together and watching each others interests grow and re-shape is has been wonderful.

Let’s get down to brass tacks here:

Married couples can run their finances in a variety of ways. This is what we do:

We run 3 accounts, and 3 separate budgets:

- A joint account – paying for all joint expenses including food, take-out, activities we do together, the mortgage, the car, insurance, pets, cable, internet, and joint savings goals.

- My account – paying for my clothing, my hobbies (fountain pens, crafting, books), trips with my friends, food I get for myself when I’m out – so coffee – lol, my phone, and my personal savings goals.

- My partner’s account – paying for his clothing, his hobbies (running, books), trips with his friends, food he gets for himself – so beer – lol, his phone, and his personal savings goals.

Yes, we are both still on phone plans with our families. It’s an emotional chord we don’t feel like pulling – yet!

Each paycheck we deposit an equal amount into the joint checking account (currently $900 each), and the remainder of our paychecks get deposited into our personal checking accounts. From there, all joint bills are covered 50/50, and we are free to spend any of the excess money deposited into our personal accounts at our own discretion. This way, neither of us need to validate to the other when we want to buy a $500 fountain pen or $200 pair of running shoes. But we do still review our individual budgets with each other to cheer each other on toward our individual goals or offer insight how to more strategically save for a goal.

Once we reach FIRE, we will operate a similar financing structure. The joint account will be “paid” from our retirement accounts – 401(k)s, IRAs and Roth IRAs, and our joint brokerage account. We will each generate our personal discretionary spending from our individual taxable brokerage accounts and any FIRE passion work that brings in a paycheck. That is why our $1.5M FIRE goal is only made up of certain accounts, and isn’t an overall net worth watermark. My goal of saving $10k into my taxable account this year won’t be included in the $1.5M FIRE number, that will just go toward my personal discretionary cash in FIRE.

2022 Goal Progress

I am a little over two months into my new job! So far, so good. I am going back into the office 3x a week, which I actually truly enjoy – so yay for me! I know settling in to a new job takes time, and I do feel a little impatient to get over that rookie feeling hump.

In August, I hit my FIVE YEAR ANNIVERSARY with my company. That means I am fully vested in the 401(k) plan! If you had asked me when I first entered the workforce and changed jobs 4 times in 2 years whether I would ever stay anywhere long enough to vest, I would have laughed and dodged the question for fear of judgement. But look at me know y’all!! A dedicated corporate drone:)

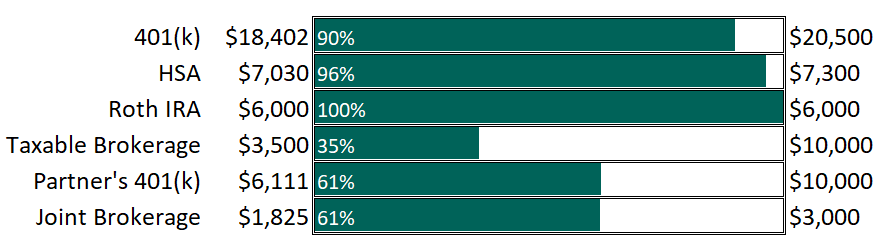

The retirement accounts are on good track to fill up by year end. My taxable brokerage account is lagging! At this point, it’s a toss up on whether I will pull it off. My HSA will be full after my next paycheck so maybe I will really put the pedal to the metal after that. Maybe. You may have noticed a new Joint Brokerage goal snuck onto the list – we decided we want to pull together the $3k we need to start investing into a Vanguard mutual fund this year. And with the market steadily sinking it is a great time for us to get started and then set up a bi-weekly deposit from there.

Thank you for checking back in with me – see you next time!!

One thought on “FIRE & Marriage”