Happy New Year FIRE Flowers!

We are closing out our first year together! Gosh – I’m so excited!

My last post of the year (or technically, I suppose the very first post of the year ha) will always be a year-end wrap up.

The topics we will cover are:

- Annual Expense, Income, and Net Worth Review

- 2022 Goal Results

This year has been wild – between our travel adventures and the rough market landscape – it felt like it went by in a flash. Our travels were very healing after two years of work from home confinement due to COVID.

As most of you are probably aware, the fed as been consistently raising the fed funds rate, even this past month they decided to raise it another 50 basis points to put the total range at 4.25% – 4.50%. We have our checking and savings accounts with Ally bank, and Ally has been raising their savings interest rate alongside the Fed increases. They are currently at 3.30% – we are getting nearly $20 in interest deposited across our savings accounts each month! That’s neat. I haven’t been alive to experience a time where we have meaningful savings account interest rates. Times like these are why there is a little more benefit to being with a bank that compounds interest monthly instead of quarterly.

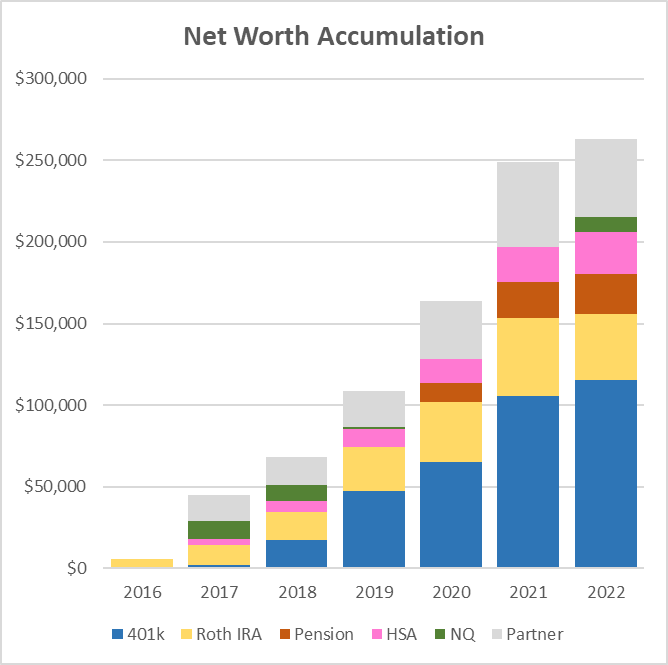

With the market dawdling downward for the whole year, it felt like we were saving money that was immediately evaporated. We saved over $50k, and the total value of our accounts has increased only $15k. Ouch!

Expenses:

I mentioned in my first post that I would pull year-in-review expense information. And I have done that:) For really the first time in my life. And I am a little shook with the results lol this will be a situation where you realize that this FIRE Flower is certainly not on a *frugal* FIRE journey!

Let’s break this down by category – reminder these are monthly averages:

Joint Account: $1,950 From every bi-weekly paycheck, my partner and I each deposit $900 into our joint account (increasing to $1,000 in 2023!). The joint account runs its own budget and covers all joint expenses including the mortgage, utilities, household groceries, eating out together, the car expenses, HOA dues, etc.

Wishfarm: $687 This blew my mind. It’s my second largest monthly expense and IT WAS ONLY THREE THINGS. I had one last tuition payment from my MBA for $3,812, I bought a Dyson air purifier for our condo for $701, and I bought custom closets for our condo for $3,732. Below are some before and after pics of our closets! We don’t have a storage unit in our condo so optimizing our closet storage was something I really wanted to do. I am enjoying the way spending money in our small condo goes much farther than spending money in our house ever did.

Travel with Friends: $310 In January, I spent 10 days in Florida with my college friends at Universal Studios, plus one day at Disney. Those same friends came out to visit me in Baltimore, and we spent a day in DC. Then another friend visited me in Salem, and in November, I flew out to visit her in North Carolina. Most of the Universal expenses technically booked in 2021, but even so, I was surprised that this was as low as it was considering all the friend travels that I had this year. I’m not expecting this to be nearly has high next year – but it’s also okay if it is 😉

Shopping – Clothes & Shoes: $212 Eh, this is a little high, but I did return to the office in August and bought a few new pieces. I prefer to invest in more expensive clothing and shoes because I want to pay for quality, both from a literal standpoint and an environmental/ethical standpoint.

Shopping – Hobby Spending: $264 You may have thought custom closets was a frivolous expense. But, wait! Haha! Hobby spending is pretty much what I spent on new fountain pens this year. We went to the Baltimore Pen Show in March and I got two new pens, and then when we drove to Brooklyn we went to Yoseka Stationary and I bought a new Sailor pen. Plus a few purchases during holiday sales for myself. In addition to fountain pens, this budget bucket would also include yarn for knitting, paints for painting, or scrapbooking do-dads.

Shopping – Other: $212 This is any other shopping that I do that doesn’t fall into any of these other shopping categories. A catch-all shopping bucket.

Gifts: $183 This is all birthday and Christmas gifts!

Misc – Obligation Spending: $149 These expenses added up to me more substantial than I was expecting. This bucket includes things I have to pay but would prefer not to like haircuts, dry cleaning, house supplies that I cover for the joint budget, and credit card annual fees.

Food – Out: $137 This is when I eat out and my partner isn’t with – so meeting up with friends for dinner, or grabbing lunch in the skyway at work, or ordering Doordash for just myself.

Food – Home: $104 This is when I am either covering a grocery bill for the joint (Baltimore’s cost of living was much higher than we are used to, so I did this a fair amount during the 3 months that we were there) or when I go the grocery store and get myself a basket of goodies.

Shopping – Target: $75

Shopping – TJ Maxx: $92 – I distinguish Target and TJ Maxx purchases both because I have that specific store credit card, and because I know that if left un-monitored, my swiping at these stores can get out of hand. TJ Maxx used to be my kryptonite, but as I mentioned earlier, I’ve been putting more stock into the quality of goods I bring home, so my spending at TJ has already slowed down from previous years – thankfully!

Food – Coffee: $32 I love a warm mocha when it’s cold, and an iced latte when it’s warm! And I enjoy the coffee shop atmosphere, so I don’t mind paying $8 rent to haunt a table for a couple of hours now and again.

Car Fees – Lyft & Parking: $22 This would be another instance of when my partner isn’t with and I take a Lyft or drive to something where I need to pay for parking.

Streaming: $20 I cover our main streaming subscriptions: Netflix and Hulu. And then we will sometimes rent a movie on Prime and it all averages out to $20/month.

Books: $11 For the most part, I participate in the Free Library community (both for taking and leaving books!), but if I want to read a specific book, I will order it used on Ebay, so I keep a running book allotment for when those pop up.

Giving: $8 I kind of wish this wasn’t at the very bottom of my expense list, but at least it is here! I have a goal to increase this next year. I give to GoFundMe campaigns and various causes that I support.

“Be known for what you allocate, not what you accumulate”

Joan Holmes

Income:

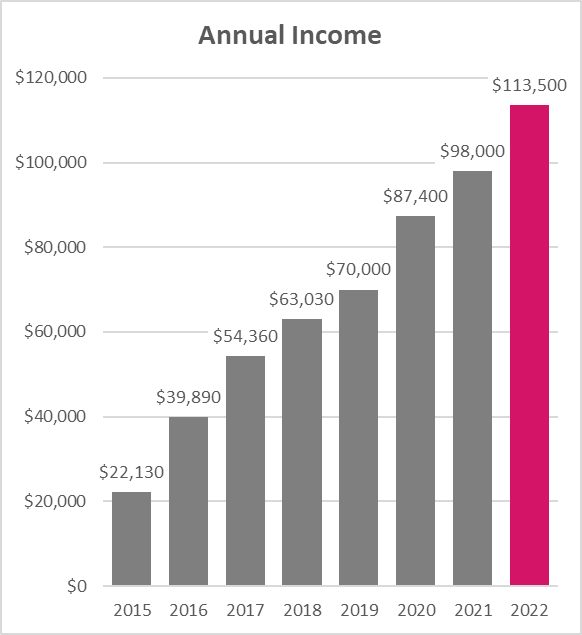

My total pre-tax income for the year was: $113,500. This increase from the previous year was due to my switching jobs at my company in July – I officially hit a six-figure base salary ($100,000 flat, but it still counts!) and our annual bonuses came in above target, which was great.

Since my income is rising well beyond our expense needs (and to hopefully help cut by personal spending) next year I’ve set up my brokerage account to get deposits directly from my paycheck. My theory is that if I don’t see it deposit into my checking, then I won’t spend it! I’ll keep you posted on how this scheme works out…

Net Worth:

2022 Total Net Worth: $263,150

The NQ category includes both joint and my personal taxable brokerage accounts.

My partner’s net worth includes 401(k) and IRA balances.

As a reminder: our individual brokerage accounts will only be used for personal expenses in FIRE, so they do not count toward our $1.5M FIRE goal.

This year we saved just over $50,000, which was a 40% savings rate. In 2023, we have set savings goals for ourselves that should push us up to a 40% savings rate.

We are 17% of the way to our FIRE number!! It is intimidating, but neat to see that we are a quarter of the way there in our roth accounts. That’s nothing to scoff at! Even though we haven’t gotten a large chunk building in our taxable account, we at least got started this year – and that can be half the battle! We have an auto-saving and investing plan set up for 2023, so we are in good shape for growth there.

2022 Goal Results

I wish I could tell you we were at 100% across the board – but no…

I wasn’t able to save $10k into my taxable brokerage account. I made it halfway. I think I will use the $5k that I did save to quickly fund my Roth IRA next month for 2023.

Other than that we did a great job at saving! We were able to save a total $51,800 – and that doesn’t include our employer matches in our 401k’s or my employee pension plan. Great! Unfortunately, as you can see in our net worth above, all of this savings only really lifted out total account value by less than $15k. Yeesh. I keep looking at market recovery historical graphs to remind myself of the benefit of putting money in while the market is down. Keep hanging in there everyone!

That is everything for today – my first year of blogging is official.

Here’s to a great 2023 🙂