Hey there FIRE flowers!

The topics I am going to write about today are:

- Bonus Savings Strategy

- Phases of Life

- 2023 Goal Setting

One exciting piece of news for the new year: two weeks ago we adopted a 5 year-old grey boy cat – named Moe! 🙂 He has been adapting so well to our routines. It’s great to be a mama!

And the required pet-tax:

Bonus Savings Strategy:

March is Bonus Season for my company! Since many corporate companies operate on a similar schedule, now seems like a good time to review how I try to make the most of my bonus.

Here is my multi-part, highly complex, bonus savings strategy:

I put as much of my bonus in my pre-tax 401(k) as possible.

Whoof. That’s it. I hope you are all still here with me!

My 401(k) allows for a maximum contribution of 75% of my paycheck – so that is where I set it.

The largest benefit for doing this is TAXES. This shields an enormous portion of my bonus from being taxed. And bonus payments, at least in my state, are taxed at a higher rate than income tax. Another smaller benefit is that using my bonus to fund my 401(k) takes the strain off of my paychecks for the rest of the year at contributing to fund it.

Here is an example with numbers so that you can see the tax benefit in action:

| 75% Contribution | No Contribution | |

|---|---|---|

| Total Pre-tax Bonus | 20,000 | 20,000 |

| Pre-tax 401(k) | 15,000 | 0 |

| Money to be taxed | 5,000 | 20,000 |

| After Tax Payout (40% tax rate) | 3,000 | 12,000 |

| Total Net Worth Increase | 18,000 | 12,000 |

This strategy retains control of 50% more bonus money than if the bonus were taken in cash. The larger the bonus, the more significant the benefit. And! If your company allows for more than a 75% contribution, it could be an even larger difference.

One note to keep in mind – especially if your bonus is large enough that it might max out your 401(k) in one fell swoop. If that is a likely outcome for you, consider going to your 401(k) website, find the Summary Plan Description, and search for “true-up”. If there is a true-up clause, you are good to max your 401(k) anytime during the year and your employer will still deposit their matching contributions after the end of the year. Some 401(k)’s will only provide the company match on a per-paycheck basis. If your Summary Plan Description does not include a true-up clause, then you may want to consider reducing your bonus contribution so that you will be able to contribute the minimum matching amount in each of your remaining paychecks throughout the year.

Disclosure: This should not be considered financial advice.

Phases of life:

I come from a town – and a family – where a persons life story can be summarized in a single breath: I was grew up here; I built my life here; My job is at the local company, and I plan on living out my days here. And not in any sad way – this simple life is one lived with pride. And I love that for them. But it never resonated with me.

But I never felt a peace like that where I grew up. Or around the people I grew up with. Growing up to me always meant going away. Maybe it’s my Sagittarius nature, but I love change. I love a shake up to the mundane – even if it’s a negative change. The uncomfortability usually pushes me along to a new adventure in the end.

Every now and again I would meet someone whose life story was different. It took longer to relay and was a much more engaging story to me: I grew up somewhere. I built a life somewhere else. I worked in this career, and then another one. I’ve traveled, loved, explored, and lived. And I plan on staying here for awhile. Until I try something new.

That’s what I wanted for my story – one that is long, and colorful, and tailored to my many interests.

I read a TON growing up (my form of escapeism ha) and it lit an fire for my ambitions and the type of life story I could create for myself. I have the patience to set and reach long-term goals, so the FIRE aspiration fit me like a glove.

I see my future in buckets of time.

- Accumulation Careers (Ages 25-35)

- My partner and I have jobs that pay us enough to achieve financial independence. We are interested in our fields of work, but not to the extent that is doesn’t feel like work.

- Nearly FIRE & Immediate post-FIRE (35-40)

- Nearly FIRE we will be in the process of relocating to Baltimore.

- I imagine we will go a little bonkers traveling for awhile. Get our full fill of adventure, until we are craving structure and routine again.

- Passion Careers and Family (40-50)

- We plan to adopt to grow our family. Rearing our kiddo(s) will be our focus during these years, and any part-time or hobbies will slot around in time when we aren’t with the kids.

- Post-FIRE Retirement (50-60)

- Traveling Adventure pt 2 – likely slower travel and more international.

- Slow-down Retirement (60+)

- Spending more time in our communities. Our days are more routine.

Of course this whole plan could fly out the window at the drop of a hat! Ha! But generally, this is how I view my life. I make the effort to be present for each phase. I am not trying to hurry through the current accumulation phase because there are a lot of great things about it too. We love our condo and downtown location. I enjoy taking the train into work a couple days a week and meandering through the skyways throughout the workday. We keep up on our hobbies and social circles in the evenings and on weekends – I knit, read, write, go outside, play games, and go to the gym. My partner enjoys running, birdwatching, and reading. And together we play tennis, rollerblade, hike, and go to the theater. It’s a lovely phase that I don’t want to view as a means to and end.

2023 Goal Setting

This time around I’ve decided that in addition to sharing my financial goals with ya’ll, I will also include my personal goals as well!

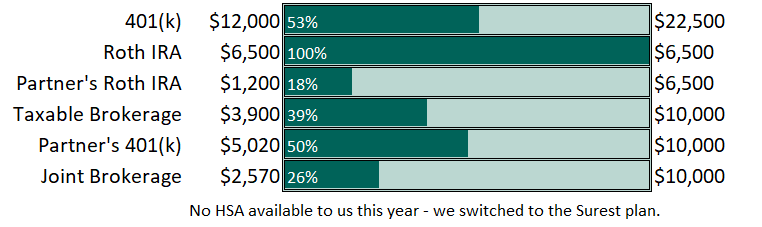

The financials goals are as follows (and updated with first quarter progress):

We’ve had a pretty strong start to the year! Although since we are already past bonus and tax season, there aren’t many more opportunities for windfalls. Reaching the rest of these goals will just be based off of scheduled incremental paycheck contributions.

This year we hooked our paychecks directly up to our brokerage accounts so that our saving is more automated than it has been in the past. We also set up auto-saving and auto-investing schedules for our joint account so that is automated as well. Already I can tell the difference – I like the change!

I am going to share my personal goals this year too – because what the heck! A little more accountability can never hurt!

Read 50 Books – simple enough, and on track to complete! I like to read both nonfiction and fiction. For nonfiction I’ve been interested in nutrition (see 4th goal lol), retirement strategies, and longevity studies. I’m also in the middle of the Seige & Storm series right now for fiction.

Take a trip by myself – I like my independence. I like adventure. To stoke these two qualities, this year I will set aside a long weekend and take myself on a trip somewhere!

Free Writing Notebook – I’ve taken a couple of writing classes and we have reviewed the exercise of free writing. I have a pretty thick notebook (let me get a ruler… okay, it is 1.25 inches thick) and I will fill it with my free writing thought meanderings over the course of the year. This one will be a challenge! This is one of those things that it is pretty easy to NOT do everyday.

Lose 35lbs – woof. We are personal now! Let me confess: I gained 20lbs during COVID work from home. I mentally crumbled and comforted myself with food. And gyms closed. I can give many excuses. Last year, while we were traveling, losing weight wasn’t a priority. No way was I not going to enjoy my fill of lobster rolls! But since we are back, now seems as good of time as any to take care of my body. 9lbs down. On good track to meet this goal. I’ve been doing 20:4 intermittent fasting as my main tactic. I also make sure to get enough sleep and drink 90 oz of water each day.

Have a great spring FIRE Flowers 🙂

Talk to you in June!!