Welcome to 2024 🙂

I’m excited to be starting my year by writing out another post with my FIRE Flowers! These year-end wrap ups are so cathartic to write. Hopefully they are just as fun to read! Ha!

The topics to wrap up 2023 include:

- Travel Updates

- Annual Expense, Income, and Net Worth Review

- 2023 Goal Results

Travel Updates

This year the has a heavy travel year. I took my PTO balance down to low double digits, which is a first for me, and well worth it! My travels included: Cancun, Chicago (IL), Lake Okoboji (IA), Baltimore (MD), Greensboro (NC), Shallotte (NC), the Florida Keys, and Phoenix (AZ)! Woohoo!

In November, my spouse and I attempted to *drumroll please* rollerblade down the Florida Keys!!

We read that there is a 100 mile trail that runs from Key Largo down to Key West called the Overseas Heritage Trail. We used a couple REI gift cards that we got last Christmas to buy rollerblades and spent the summer learning how to rollerblade. (i.e. we rollerbladed a total of 3 times, and at least one of us fell over during each practice session). We each packed a backpack of our belongings for the week that we would carry on our backs as we bladed. The rollerblades were picked in a duffel bag that we folded up and put in a backpack when we were on the trails.

We flew into Miami and took a Lyft to the trail head in Key Largo. We booked our first hotel about 8 miles down the trail for the first night (we didn’t get to the trailhead until about 5pm), and we made it! We rollerbladed the full distance, checked into our hotel, and got dinner at a neat bar next door!

The next morning we popped back onto the trail and set out for a full day of rollerblading. We booked a hotel about 25 miles down the trail in the key of Islamorada. We made it about 13 miles down the trail before we lost the trail, gave up, and called a Lyft. This was also about the time when the realization that the trail isn’t exactly maintained to a rollerblading standard was sinking in. There were gravel pebbles everywhere, and each intersection had those plastic yellow bumpy pads – and there were A LOT of intersections,. Also, for some stretches, the trail doubled as the shoulder of US Highway 1. It was a little too close for comfort, especially given the pebble population and our mediocre rollerblading skillset!

Naturally, we called a beach day the next day and spent the day at Sombrero beach!

Then back on the trail the next day as we rollerbladed into Marathon key. We rollerbladed about 15 more miles to our next and made it to our final resort that we booked for the last 3 nights. All in all, we traversed half of the Overseas Heritage Trail, and of that we rollerbladed just over 35 miles. We did take a bus down to Key West too! So we were able to see everything we came for, it just happened differently than I was expecting.

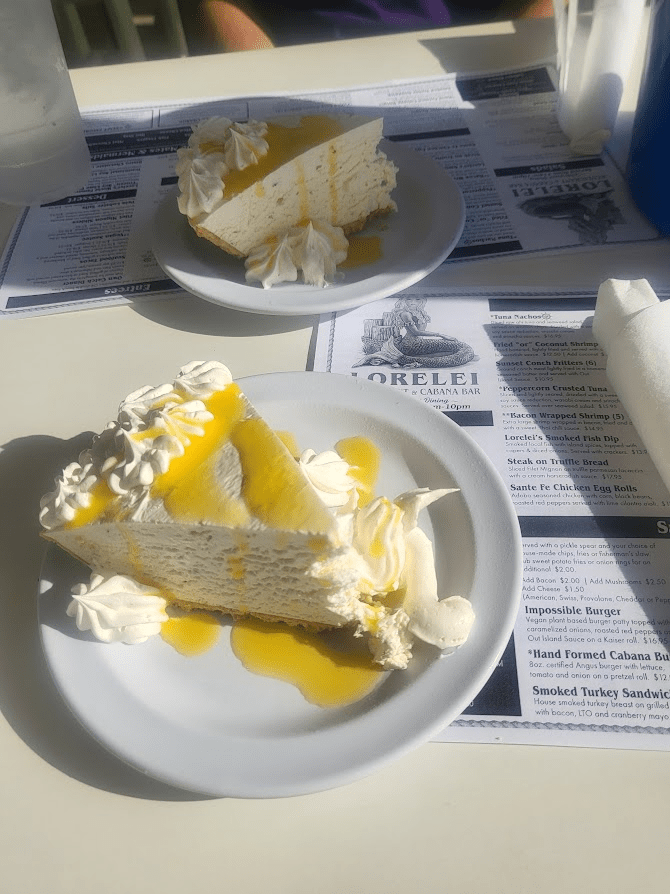

The real star of this trip was: Key Lime Pie. We stinking LOVE key lime pie, so a trip to the Florida Keys was probably one of the more apt destinations for our taste buds. Please see below for a collection of slices that we had the pleasure of enjoying:

For my final trip of the year – I flew out for a spa weekend at a resort in Phoenix over the first weekend in December! I left on a Friday, spend Saturday and Sunday mornings in the spa getting massages, a facial, and a body treatment, and the afternoons poolside with a book, and then flew back on Monday. It was such a great treat! I relish in alone time, and the length of the getaway was just perfect.

Expenses

What is this? A travel blog? LOL let’s get back to the MONEY!!

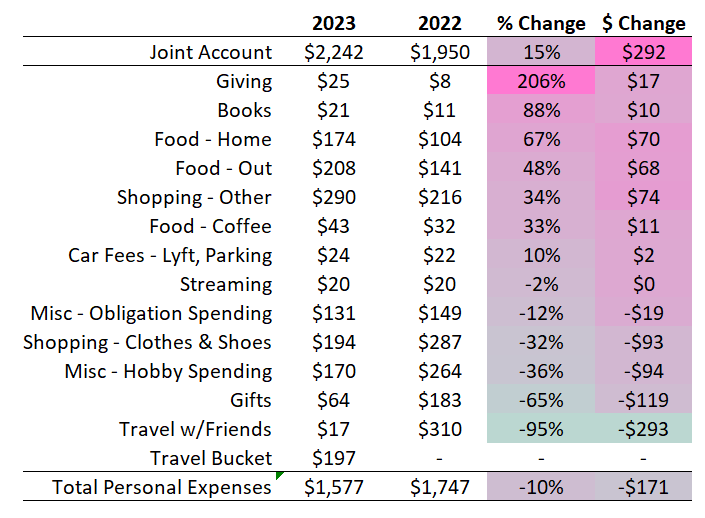

See below for a gaudy graphic (next year, let’s forgo including the joint expense. That should clean up the view.)

Here is an easier to digest table review:

A few quick things I see from these:

- Last year, I made a point of wanting to donate more this year – and that is the category with the greatest % change! Awesome! It is also not the last category on the list this year. Good.

- Coffee went up 33% – and I don’t feel like I was drinking more than last year. So, not to be that person, but if there were a category that I could blame on INFLATION – this would be it haha. Someone recently compared getting a weekly cup of coffee to having a smoking habit and I cannot get it out of my head. Honestly, a drink costs me about ~$8 now, and I don’t know the price of a pack of cigarettes, but I just googled it and the average is $8.39. Nooooooo.

- The categories are stacking up closer to alignment with my values this year. Shopping for shoes, clothes, and ‘other’ both decreased pretty significantly. Plus, last year I had Wishfarm expenses of $687/mo that I eliminated this year.

Highest to lowest – let’s dive in!! As a reminder, these are monthly averages.

Joint Account: $2,242 This is money directed to our joint account from every bi-weekly paycheck, my partner and I each deposit $1,100 into our joint account (increasing to $1,300 in 2024!). The joint account runs its own budget and covers all joint expenses including the mortgage, utilities, household groceries, eating out together, the car expenses, HOA dues, etc. Next year, we are also going to start a family (phone plan, that is 😉 ) so the increased savings will cover that new bill plus extra joint non-qualified savings.

Shopping – Other: $290 This is any other shopping that I do that doesn’t fall into a specific category of shopping. A catch-all shopping bucket. Fine, it’s probably 50% Amazon.

Food – Out: $208 This is when I eat out and my partner isn’t with – so meeting up with friends for dinner, or grabbing lunch in the skyway at work, or ordering Doordash for just myself. This increased 48% this year, likely due to traveling on my own more and the price of eating out getting more expensive.

Travel Bucket: $197 This is a new bucket this year, since I didn’t have any solo trips last year. I am continuing to save into it each month because I really enjoyed my trip to Phoenix this year and I definitely want to keep some personal travel money around.

Shopping – Clothes & Shoes: $194 I started kicking out the plastic from my closet this year. I had been putting it off ever since reading Overdressed: The Shockingly High Cost of Cheap Fashion in the summer of 2022. Last fall, I put a pause on buying new clothes, knowing I didn’t want to bring more plastic into my closet, but not knowing how to source natural fiber clothes without breaking the bank! My mom and I have always been Maxxinistas (read: avid shoppers of TJ Maxx), and one Saturday in April I stopped into TJ Maxx for a hair clip and decided to peruse the clothing racks. I read *every* tag on the off-chance that I would find some plant fibers. AND BOY WAS I SURPRISED! I ended up with a cart of 100% linen, 100% cotton, 100% tencel, and some modal/viscose blend shirts! Enough of tops to replace the polyester line-up that had been in my closet!

Once the tops were turned, I set my focus on my undergarments, pajamas, and leggings over the summer. I feel so much more invested in the pieces I bring into my closet, and I care for the ones I have. Even though it’s an upfront expense, this has been a great achievement for this year.

Food – Home: $174 This is the grocery store! Sometimes I cover a grocery bill for the joint, sometimes I’m shopping just for myself. This is higher than I would have expected, but I’m not going to worry too much about it. We have an expensive grocery store a block away from our condo, so it’s probably too many ‘convenience’ trips instead of getting a list together and venturing out to Aldi.

Shopping – Hobby Spending: $170 Similar to last year, my hobby spending expense is pretty much what I spent on new fountain pens this year. We went to the Chicago Pen Show in May! Plus a few purchases during a holiday sale. In addition to fountain pens, this budget bucket also includes yarn for knitting, paints for painting, or scrapbooking do-dads.

Misc – Obligation Spending: $131 This bucket includes things I have to pay but would prefer not to like haircuts, dry cleaning, house supplies that I cover for the joint budget, and credit card annual fees. It happens. IDK.

Gifts: $64 This is all birthday and Christmas gifts! This reduced quite a bit – at this point, I’m concerned I missed somebody’s something this year…

Food – Coffee: $43 I so enjoy the atmosphere of a coffee shop, or strolling through the Minneapolis skyways with a brew… This is probably high to some people, but I do not care. A weekend morning at my coffee shop is priceless.

Giving: $25 I have an actual strategy for this category this year! I have a calendar reminder every month to donate on my work calendar (the calendar I take seriously ha). Each month I give to one of the following four organizations:

- Union of Concerned Scientists

- Project Prevention

- Charity to Educate Girls

- National Network of Abortion Funds

I found them by scrolling the blog: Impactful Ninja (https://impactful.ninja/) and looking through the “9 Best…” lists for causes that I was interested in.

Car Fees – Lyft & Parking: $24 This would be another instance of when my partner isn’t with and I take a Lyft or drive to something where I need to pay for parking. Pretty cool how this stayed relatively flat.

Books: $21 If I want to read a specific book, I will order it used on Ebay, but things started adding up this year, and I had that 50 book goal, so my partner and I started going to the local library every 3rd Wednesday and it has been awesome! Date night + free books = LOVE

Streaming: $20 I cover our main streaming subscriptions: Netflix and Hulu. And then we will sometimes rent a movie on Prime and it all averages out to $20/month.

Travel with Friends: $17 This year we only went on a simple road trip down to Iowa for a weekend! Also, we started using the Splitster App – so expenses ebb and flow more. Seems like this year was an ebb year.

Income:

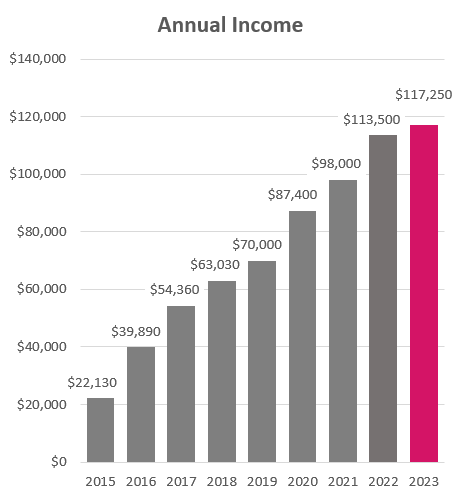

Annual Income: $117,250

Not a huge increase from last year now that I’m looking at it… I do feel like it went farther though, with expenses decreased, and joint savings increased.

Also, happy to report back that the direct deposit straight into my brokerage account help curb spending, and I stealth saved $13,000 into my brokerage account this year!

Net Worth:

2023 Net Worth: $395,550

For not having a large increase in income, our net worth came to party this year! All of our accounts are putting up highwater marks right now, which is always exciting to watch.

And as of typing this, we have passed the 25% mark of our full FIRE goal of $1.5M!!

I did an enormous amount of thinking around tax bucketing our FIRE assets this year. I’ll write up a post about it to go more in depth for Q1! You may notice that the goal numbers for the tax buckets have been tweaked pretty substantially, but with these bucketing sub-goals we should have an easier time funding our FIRE life before we turn retirement age. Those early years of funding take a little more finesse to access to retirement account dollars.

2023 Goal Results

WE SLAYYYYYED!!! All completed, and some even beyond expectation!! We did a great job at saving this year! We saved a total of $74,000, inclusive of our employer matches in our 401k’s and my employer-funded pension plan.

Read 50 Books: Some of you may have doubted me *side-eye to my partner* but I did it! I finished my 50th book of the year just last night. And to say that I have been binge-reading for the past 2 months would not be an overstatement haha!

Take a trip by myself: A weekend away at a Spa Resort in Phoenix did the trick for this goal. Check!!

Free Writing Notebook: I pretty much stopped writing and started reading for the last three months of this year. I did miss writing though! I am looking forward to get back to filling up pages in this notebook in 2024. Next year I will find a better balance between reading and writing.

Lose 35lbs: Okay, okay. It was a lofty goal. And I did make progress. I’m not going to be upset – I lost 12 lbs! It won’t be any formal goal in the future or anything, but I will keep you posted if I ever happen to meet it.

Peace out flowers!! Have a great start to your 2024!