Ah my favorite post of the year is here! Time to see how 2025 shook out.

Taking a moment for a personal look back – I was a pretty big fan of the year. Our first full year as Baltimoreans. We experienced every season of the city! It was fantastic. And I feel more knowledgeable on how to structure plans in the coming year. We’ve signed another 15 month lease at our place! Big items of personal accomplishment this year include:

- We adopted Wyatt

- I learned Sudoku (even the hard levels!)

- I beat my first videogame (Blue Price)

- My partner and I beat our first co-op videogame (Sackboy)

- I read 58 books

- I took my longest yet solo trip to Cancun

Okay – let’s get back to the business. Topics covered will be:

- Expenses

- Income

- Net Worth

- Looking Ahead

Expenses

To summarize: I am not freaking out.

We are still paying monthly for the Condo in Minnesota and that sucks. It’s inevitably going to make our numbers look crappier than they could be this year. But we did use the place. We went back to Minnesota three times, and my partner stayed for three weeks in August by himself, so we tried to make use of the expense. We don’t actually have it listed on the market right now, but we will put it up again this spring and hopefully it will sell this time.

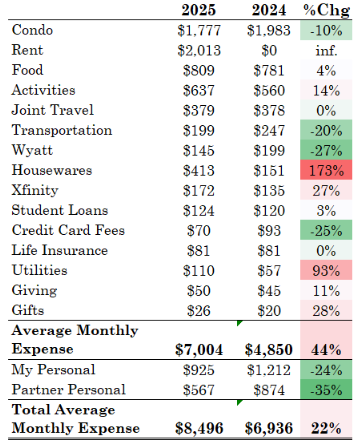

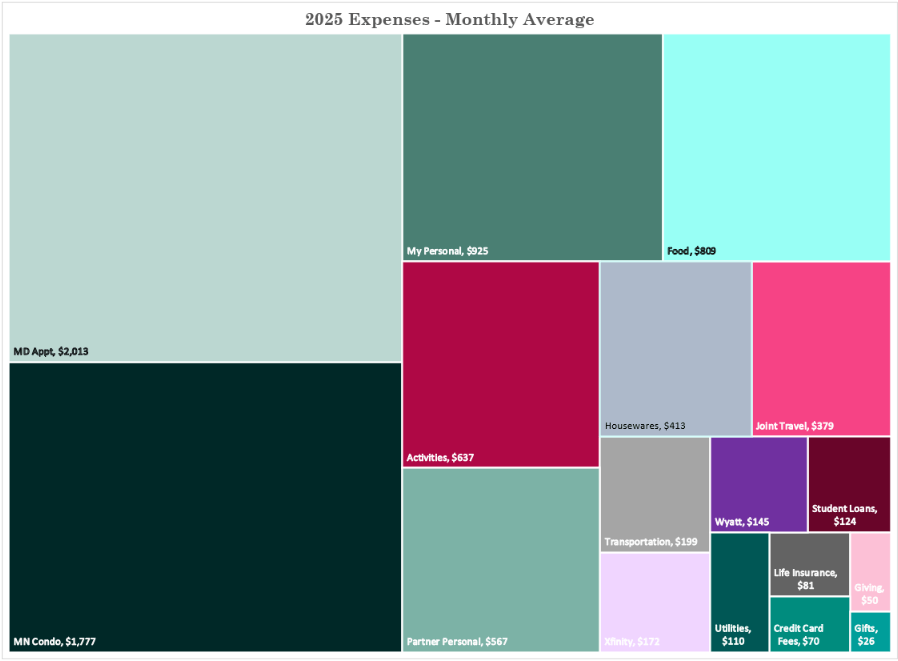

Here are the numbers in the usual categorical breakout:

If we were to have dropped the condo expenses, our total average monthly expenses would have come in at $6,669 – a 4% drop! Thanks to personal expense decreases and not having a car. That perspective calms me and will help steady me as we talk through what was actually a 22% increase in expenses in 2025. Womp womp. Let’s go!

MD Appt & MN Condo: $2,013 & $1,777 I’ve lumped these together because Housing. I mentioned above that we signed another 15 month lease in Baltimore. It was a 5% rent increase. BUT that $2,013 included $75/mo in a storage unit that we have cleared out and ended, so this next year should be a wash. Good! And the condo assessment was paid off at the end of last year, so that isn’t a bonkers monthly payment if we were actually living in the condo ha.

Food: $809 This is great in my opinion. It includes groceries and takeout. A 4% increase in a year of inflation and having moved into a bigger city without a car to go grocery shopping with. We shoot for one ~$150 Amazon Fresh order per month and then a weekly stop at our local grocery for ~$100, and we order takeout maybe twice a week at $50 per.

Activities: $637 This was a nice increase, and I wanted this to happen. It means we are doing more! This year we got tickets to a Fever game, went to festivals in our neighborhood and the movies, and tried new restaurants and bars! This is a spend where you want to live bucket. This is life!

Housewares: $413 I do not love that this one came in above Joint Travel. I believe it’s kind of lingering expenses from the move. When we terminated the storage unit, we bought some organizing stuff. We’ve changed out a couple furniture pieces. I’m calling this a fluke, so we’ll circle back next year to see if that’s true or not….

Joint Travel: $379 Increased by $1 Bob. Weird! We did take trips: MN, Richmond, VA, Hershey Park, and Cumberland, MD. This is a fair and expected expense. This is another spend where you want to live bucket so all good, although as a note we aren’t planning a whole lot of travel for 2026.

Transportation: $199 Decrease of 20%. This is the no car lifestyle. Very interesting. Includes Lyft and Uber fare, train tickets, our MD licenses, and we’ve joined ZipCar so those rentals and that membership fee too. I think I will write up a post next year comparing the car life to no-car life. Hmmm yes, that’s a good idea.

Xfinity: $172 This covers Internet and Phone. Up 27%?! wtf. Apparently our sign-up discount expired. I did call in October and did the whole song and dance for a discount and in December our combined bill was $144 so maybe I’ve tackled this back into submission. Sometimes I think about once I’m done working maybe we don’t need internet? But also, we probably do. I wish it could be included in Rent ha.

Wyatt: $145 Considering we adopted him in July and his expenses are averaged over twelve months, this is going to be higher next year. But there were some initially high months when we got him beds and perches and toys that won’t be recurring expenses. He did already have a trip to the ER this year ha! But he is all better now and a healthy baby boy. (Cat. He is a cat, for any new readers).

Student Loans: $124 We pay $120 a month but the sketchy loan sharts (that was a typo that I am going to keep) took $166 out in September so the average bopped up a smidge. It’s nice to be in a position where a random overpayment doesn’t wreak havoc in our financial lives. The balance is at $8,400.

Utilities: $110 We’re paying on two places so the bills is ~double. Utilities in Baltimore have unhinged behavior so this is a bucket to helplessly keep an eye on.

Life Insurance: $81 Horray for a locked-in premiums! The two premiums cover two $1M 25 year term policies. We are six years in. I’ve mentioned it before, but my philosophy on insurance is that if you buy the insurance you won’t need it! This is an $81 guarantee we will be alive again next month. A steal.

Credit Card Fees: $70 Why did this go lower we ask ourselves? I do not know, we reply to ourselves. JK I looked. Last years averages were calc’ed over a partial year because of combining our accounts mid year. The credit card expenses were identical this year to last – no actual change.

Giving: $50 An 11% increase! Year over year increases – for the win! We are on recurring contributions, which has been really nice (although kind of a pain when you want to change things for some organizations). Our organizations didn’t change much from last year, they are:

- Union of Concerned Scientists

- Project Prevention

- Ocean Wise

- Rodale Institute

- Waterfront Partnership of Baltimore

Gifts: $26 This is one wedding present and presents for our nieces. Nice!

Personal Spending: $925 Last year I wrote that I was hoping to go sub 1k this year – ACHIEVED!! Great! This is spending on my clothes, hobbies, skincare, friends, and food or coffee that I get when I am by myself.

Income

Annual Income: $136,650

Yay for a taller line than last year! My bonus was smaller this year by ~$1k, but the raise made up the gap and then some.

I don’t expect much of an increase in 2026, and our bonuses aren’t looking too hot either. I’m managing expectations by only hoping to tick up into the $140k range for next year.

In other income news, my partner switched jobs this fall to work as an assistant mailman for Baltimore City. In a little over a year he will be promoted to a career mailman!

Net Worth

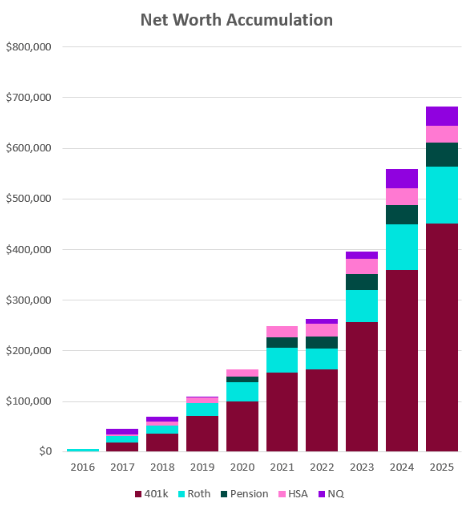

2025 Net Worth: $682,720

Up another $100k in a year!! I can hardly believe it! The market held on across this invisible and ultimately irrelevant year-end finish line. Wonderful.

I maxed my 401k, we both maxed Roth IRAs, and we saved about $10k into our joint brokerage. Total savings was $64,350 (this includes employer savings). Our net worth increase was split pretty evenly between savings and market gains with the market doing a little more work than us. Cool.

It’s exciting to see numbers that are so large it is difficult for my mind to comprehend just how much work we’ve already done toward achieving financial independence. We are just shy of halfway in terms of hard dollars, but when considering the compounding effect of the work we’ve already done, we have fewer years ahead of us than behind us!

Looking Ahead

I’m just going to take a minute here to sketch out an outline of what we are currently viewing for our future!

*The future below is contingent of the sale of our condo in 2026*

My partner moving into a job that makes him happy and can provide us with benefits was an exceptional move for our live plans. As of now, we are thinking that I will retire from my corporate work in March of 2027. My Partner will continue working for five years, and his income will cover our bills and tax expenses. For each of those five years we will make IRA conversions to fill the 12% tax bracket (the difference after his mailman income). At the end of those 5 years (2032), we should be able to draw our annual expenses from our Roth IRA (the aged conversions) and begin a financially independent adventure together!!

This is a wrap on 2025.

Happy New Year FIRE Flowers 🙂