I AM WRITING TO YOU FROM BALTIMORE, MARYLAND. Yippeeeeeee!

We’ve done it! We packed up a uhaul, drove across half of the country, and moved into an apartment in Baltimore. Our unit is great, the neighborhood has been exceeding expectations, and the work transition has been smooth!

As usual for my end of year review, I plan to cover each of the following:

- Expenses

- Income

- Net Worth

Expenses

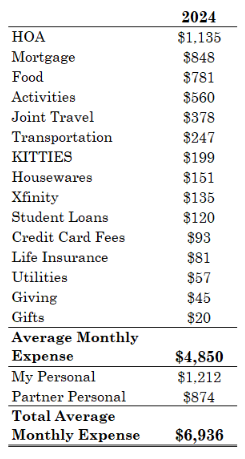

This year, after five years of marriage, my partner and I combined our accounts. In the past, we each contributed a specific amount from each paycheck into our joint account that would cover joint bills, but now we both deposit our full paychecks into the joint account and we pay all of our expenses, joint and individual, from there. It has pros and cons versus what we used to do, but overall so far so good. All that to say, the numbers are a little wonky this year because we combined in mid-April so I’ve calculated monthly averages using May through December data.

The big highlights:

- Our total monthly average Joint Expense (excluding moving expenses): $4,850

- Total moving expenses: $25,345 *scream*

- Average personal expenses for me and my partner were $1,210 and $875 respectively

Whoof – yay for accountability I suppose haha – highest to lowest – let’s go:

HOA and Mortgage: $1,983 I lumped these together, because it is really just housing expense. The HOA had an assessment of ~200/month for a new front door so this was higher than usual but still under 2k so I’m not upset about it. Our condo still hasn’t sold, so we will carry this expense PLUS our monthly rent expense into 2025. Fingers crossed it will find a new owner this coming spring!

Food: $781 Our largest discretionary expense is food! This checks out. The food in this category is groceries and takeout. We get takeout once or twice a week. We love food (have I mentioned this in nearly every post? ha) and I’m more concerned with eating healthy and tasty than eating cheaply so this is what it is and it doesn’t make me cringe too hard.

Activities: $560 This is us going out to do things! Movies, dining out, tickets to things etc. Our actual budgeted amount for this category is $300 per month, so this is interesting that it overshot quite far, but now that I am talking about it, it probably makes sense when dining out for one tab comes in around $100.

Joint Travel: $378 We only took two trips this year – both to Baltimore to prepare for the move – so this is a fairly low bucket this year! I don’t know how much I will be saying that for the rest of the categories so I should soak up typing that here while I can ha! I just peeked into last years number and it was $915/mo. Quite the drop! Note: you can’t see this number in the 2023 post since it is lumped into Joint Account expense.

Transportation: $247 This is the expense of car ownership! Insurance, tabs, gas, oil changes etc all netted out to this. It’s not crazy. We did drive a Prius, so we were able to minimize each of those expenses. I ballooned with joy when we would fill up our whole gas tank for $28 and we only needed to do that once a month. But we are carless in Baltimore now! We sold the Prius to CarMax the day before we left for $14,000. We saved half of it and used the other half to cover those obnoxious moving expenses.

KITTIES: $199 Sad, nameless reminder that our perfect boy Moe passed away this past August. He was priceless so this an expense I would pay 10x over. We kept the budget line and are saving into it each month for when we are ready for a new kitty (or plural? perhaps we will dabble in the dual-cat life??)

Housewares: $151 This bucket covers household items like soap, candles, decorations, toilet paper. We do try to be mindful of the climate impact of these purchases so in some ways that makes it a little more expensive, but overall I think this is reasonable.

Xfinity: $135 This covers Internet and Phone. We left our parents’ plans this year!

Student Loans: $120 The balance is $9,600. We are paying the minimum payment. Although any likelihood of student loan forgiveness is dwindling by the second with the new administration coming in. Shoot darn.

Credit Card Fees: $93 I know this is high. This is covering the annual expenses for three cards: Chase Sapphire Preferred, Capital One Venture X, and the Delta Skymiles Platinum American Express. I have a spreadsheet to track each cards benefits to make sure we are using them and getting back more than we are paying in. The Delta card is on the chopping block, but I will need to fly back to MN 4x this next year for work and the card really is great for flying Delta so we will at least keep it another year.

Life Insurance: $81 An important snooze-fest. The premium covers two $1M dollar 25 year term policies. We’ve had our policies for 5 years now. 20 years to go. $81 dollars a month. Honestly, it’s probably a great deal. And I think of insurance as something that if you have, you won’t ever need – but if you don’t have it, then you will have needed it. So in my mind, I am paying $81 dollars a month to guarantee we are both going to be alive next month.

Utilities: $57 This is only electric. Our HOA covers water, gas, trash etc.

Giving: $45 Another year, another increase in this bucket! I am pleased with my progress: an 80% increase from last year. I switched to monthly recurring contributions in the middle of this year, and it has been a smooth transition. This years organizations include:

- Union of Concerned Scientists

- Project Prevention

- Ocean Wise

- Rodale Institute

Gifts: $20 Gifts for people (but not each other)! Mainly our nieces and people’s littles. We didn’t have too much action in this space this year. I’m not complaining.

My Personal Spending: $1,212 This would all filter out into many of the categories that I listed last year: hobbies, clothes, food that I get by myself or with friends, travel with my friends, coffee and books. It is lower than last year, yes. But do I want to do even better next year, YES. Maybe sub 1k for a goal?

Income

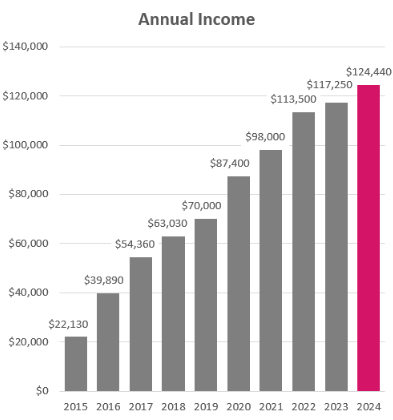

Annual Income: $124,440

This section would have been something that I felt disappointment around due to the relatively small increase from last year, given that my workload sincerely has had a greater than 6% increase, but in August I put together pitch to my boss for a RAISE! For the first time in my life, I negotiated for myself!

There is a statistic somewhere that says that women aren’t likely to negotiate their salary, and I didn’t want to be a part of that, but I had yet to advocate for myself in my career, and now I finally did it! I asked for a $20k raise and laid out exactly why I deserved it (on top of being approved to work full-time remote lol). And in November, I was approved for a $15k raise! Sweet! I have received two full paychecks at my new salary this year. Next year, along with a plump bonus (fingers crossed) the 2025 column should be looking great!

Net Worth

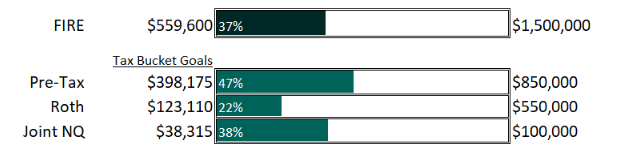

2024 Net Worth: $559,600

Woohooooo!! What a jump! Absolutely awesome. We crossed the 500k mark. Everything is looking great; the snowball is snowballing. I’m just chuffed.

I do have anxieties about the next administration, but for now, I will ride this sweet gravy train as long as I can, and go into next year keeping at the savings game. Since we are keeping our jobs a little longer while we wait for the condo to sell it will give us an opportunity to rev up that net worth up a little higher.

I’m not sure about how applicable tax buckets are going to be now that we are toying with the coast fire idea, but I’ve tracked it and here are the results:

And with that – we have concluded out 2024 Wrap Up 🙂

I hope you all have a great start to your 2025! Thank you for stopping in!!